Job Market Paper

The Distributional Impacts of Climate Change across U.S. Local Labor Markets

with John

Morehouse

Draft available upon request.

Climate change has affected households around the globe, but its impacts are not homogenous across space. We show that climate change has thus far disproportionately exposed disadvantaged demographic groups. However, household adaptation also impacts the welfare consequences of this unequal burden. We develop and estimate a new spatial equilibrium model of local labor markets, allowing households to adapt to climate change by choosing their city, energy consumption, and housing. We then simulate counterfactual climates and decompose the value of each adaptation mechanism. The lowest income decile has welfare effects an order of magnitude larger than the highest income decile. Additionally, Black households are worse off by 1.5% of income relative to white households due to climate change to-date, and we project that gap to grow by an additional 5-7% by the end of the century.

Publications

Vertical Migration Externalities

with Mark

Colas

Regional Science and Urban Economics, 2023

State income taxes affect federal income tax revenue by shifting the spatial distribution of households between high- and low-productivity states, thereby changing household incomes and tax payments. We derive an expression for these fiscal externalities of state taxes in terms of estimable statistics. An empirical quantification using American Community Survey data reveals that the externalities range from large and negative in some states, to large and positive in others. In California, an increase in the state income tax rate and the resulting change in the distribution of households across states lead to a decrease in federal income tax revenue of 39 cents for every dollar of California tax revenue raised. The externality amounts to a 0.27% decrease in total federal income tax revenue for a 1 pp increase in California’s state tax rate. Our results raise the possibility that state taxes may be set too high in high-productivity states, and set too low in low-productivity states.

Working Papers

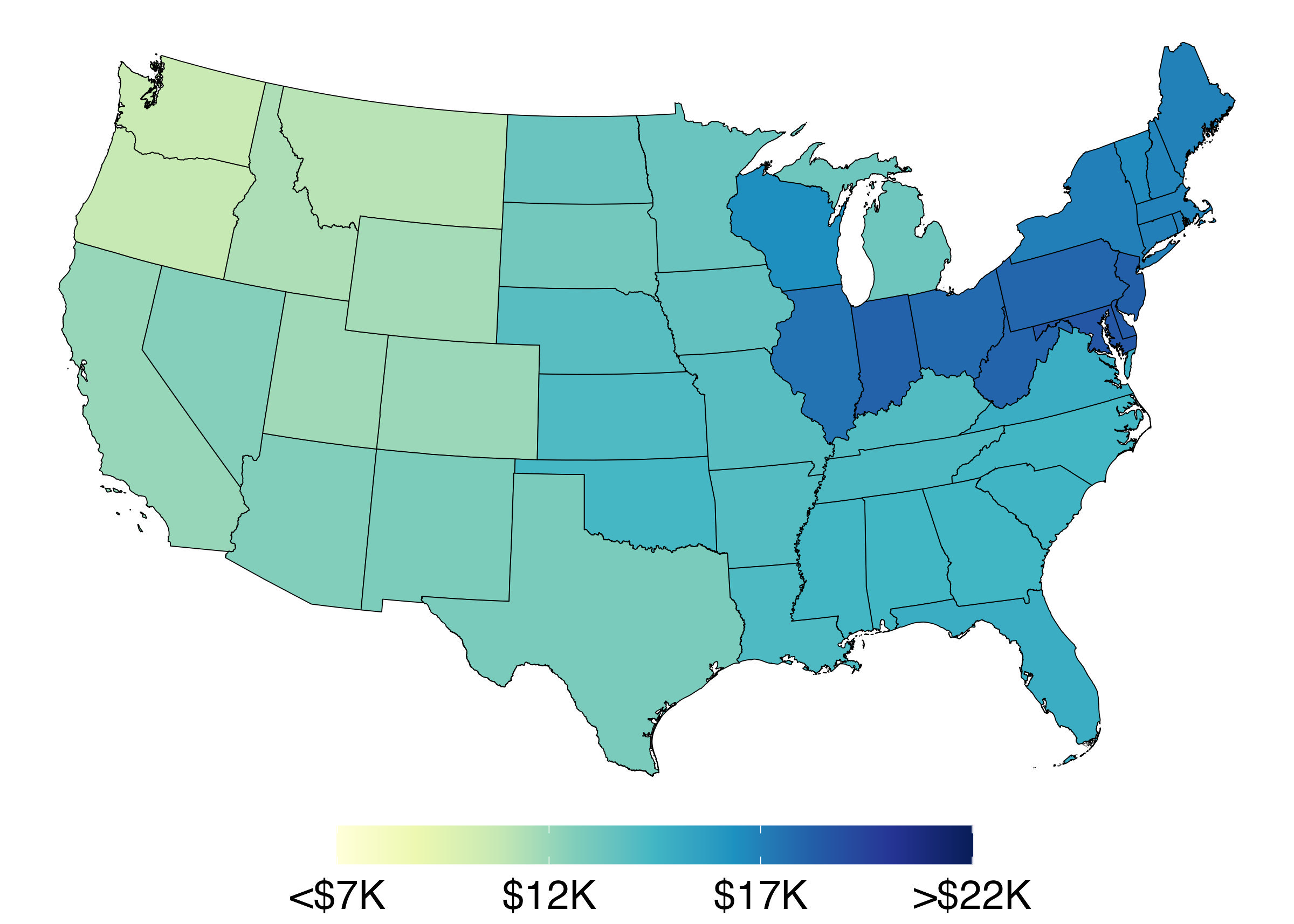

Optimal Subsidies for Residential Solar

with Mark

Colas

Resubmitted, Journal of Political Economy

Microeconomics. CESifo Working Paper

10446.

We study the optimal design of spatially differentiated subsidies for residential solar panels. We build a structural model of solar panel demand and electricity production across the US and estimate the model by combining 1) remotely sensed data on residential solar panels, 2) power-plant-level data on hourly production and emissions, and 3) a state-of-the-art air pollution model. The current subsidies lead to severe spatial misallocation. National funding for subsidies under the current system exceeds the unconstrained optimum by over 70%. Our results suggest that there could be large welfare gains to redistributing funds towards other programs.

Glyphosate exposure and GM seed rollout unequally reduced perinatal health

with Ed Rubin

Submitted. SSRN 4867914.

The advent of herbicide-tolerant genetically modified (GM) crops spurred rapid and widespread use of the herbicide glyphosate (GLY) throughout US agriculture. In the two decades following GM-seed’s introduction, the volume of GLY applied in the US increased by more than 750%. Despite its breadth and scale, science and policy remain unresolved regarding the effects of GLY on human health. We identify the causal effect of GLY exposure on perinatal health by combining (1) county-level variation in GLY use driven by (2) the timing of the GM technology and (3) differential geographic suitability for GM crops. Our results suggest the introduction of GM seeds and GLY significantly reduced average birthweight and gestational length. While we find effects throughout the birthweight distribution, low-weight births experienced the largest reductions: the effect for births in the lowest decile is 4.5 times larger than that of the highest decile. Together, these estimates suggest that GLY exposure caused previously undocumented and unequal health costs for rural US communities over the last 20 years.

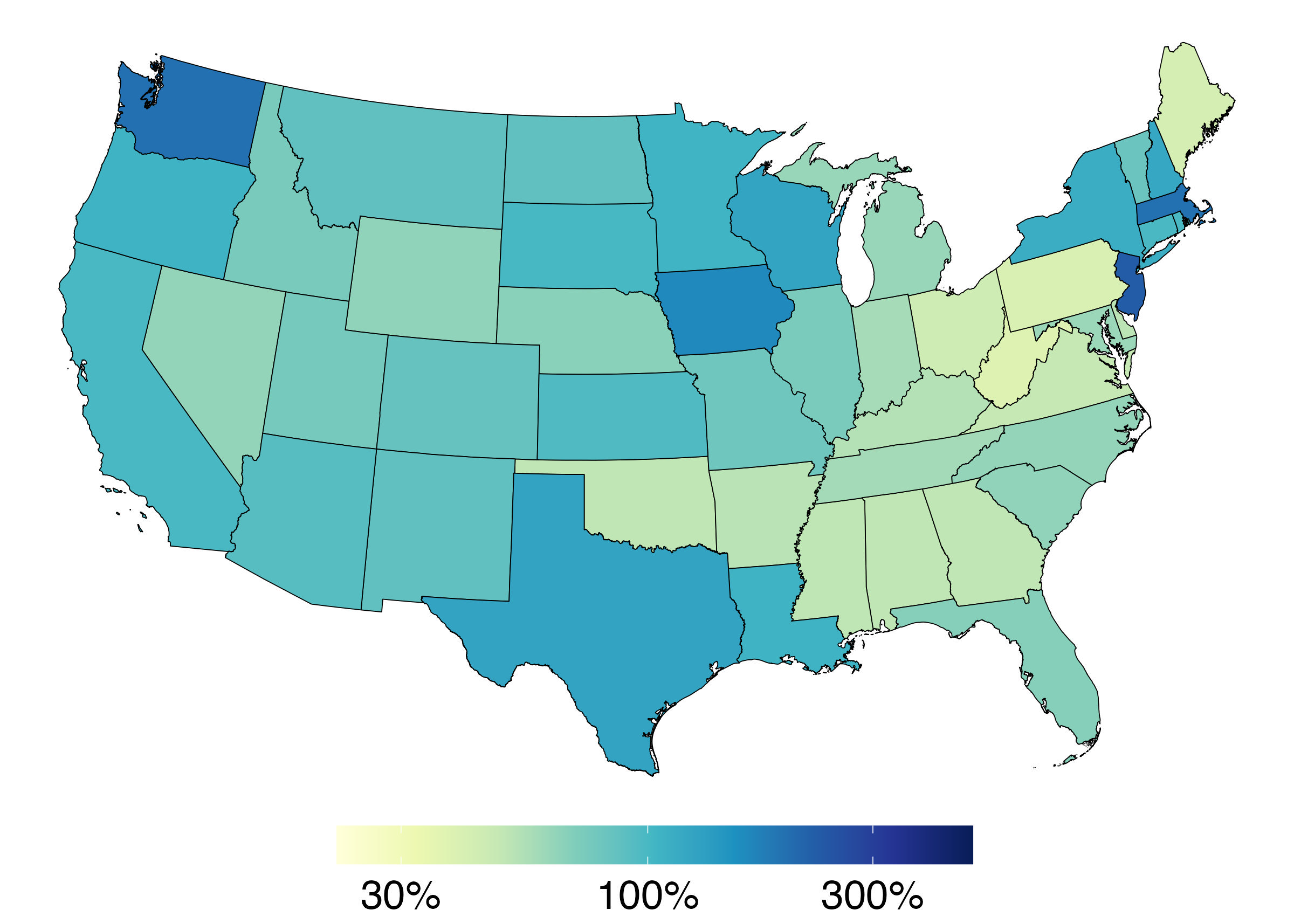

Means Tested Solar Subsidies

with Mark Colas

We study the optimal design of income-contingent subsidies for residential solar panels. Using remotely sensed data on solar panel installations across the contiguous US and a border-discontinuity design, we estimate that the responsiveness of installation rates to subsidies is strongly decreasing in the local income level. Using these empirical elasticities, we estimate a model that embeds a solar panel installation decision into a dynamic consumption/savings framework with borrowing constraints. Counterfactual simulations reveal that switching to production-maximizing income-contingent subsidies leads to a three-fold increase in public funds received by low-income households and a 2.4% increase in national solar production. Means-tested subsidies are justified on both equity and efficiency grounds.

Works in Progress

Out-of-sight, Out-of-mind? Distance Decay in Use and Non-use Value of Water Quality

with Xibo Wan